Posted originally on LinkedIn, 30 October 2023 It is with some sadness I see the collapse of Supie, the online supermarket, in the media this afternoon. I had never used Supie, and was not an investor, so my interest was that of someone who invests in startups and early stage companies plus associated funds. It’s my hope that the folks at Supie have a good support crew around them, especially founder Sarah Balle. Losing a company that you have put your heart and soul into, and to have it covered across the media, will only add to their sense of pain and grief. They will feel responsible to their staff who have been left out of pocket, their investors who have seen their capital go to zero, and their most loyal customers. Supie were brash and joyful, they celebrated their early successes very publicly, and were not shy of the media. In this sense, they will now have to endure the flip side of fame as its failure becomes covered widely. Early comments have said Supie found it too tough to operate against the big two supermarket operators without legislative changes. But they chose to operate in this environment anyway, and raised money to try and win even though they knew the cards were stacked against them. Other thoughts might include that they simply didn’t raise enough cash for the task ahead, or that the business model was simply not strong enough to be online only. I did not like reading that Supie ended with $3m in debt, with a large number of unpaid staff members, and that the likely outcome is not just administration but liquidation and little left over for staff who needed their pay. It may trigger questions by the administrator and authorities over whether the company was trading while insolvent, and whether directors of the company have more questions to answer about the company's governance. That’s why it’s also my hope we have learned more about how to behave towards young and bright founders when a startup collapses. I say it’s my hope, because I was an unfortunate witness to the public and media lynching of young company founder Jake Millar, whose Unfiltered Media company cratered in the depths of the Covid-19 pandemic. Certain media wolves with axes to grind and some self-interest descended upon that vulnerable young man, hounding him across continents. One tech commentator stated on LinkedIn that he had lined up his next column in the Herald to have a go at Jake and the “fatcats and douchebags” who backed young Jake and his team. That column was nixed by the NZME CEO Michael Boggs and his Herald Editor Shayne Currie after I went directly to them, pleading for them to stop the harassing of a vulnerable young man. To their eternal credit, those two gentlemen saw that the promised opinion piece went way too far, and did not deserve to be in the Herald. Unfortunately for Jake, other media didn’t show the same care or integrity. Jake killed himself several months later in East Africa, far away from his friends and support networks. This is where I will now choose my words with both sincerity and care. It turns out that one of the directors of Supie who resigned on Friday last week when the Supie administration was imminent, was the tech commentator I refer to above. There will be much debate and commentary over Supie, the environment it operated in, its management, governance and vision. There may be tough questions and even investigations into how the company ended up failing and affecting so many staff. But I hope we’ve learned enough about the impact of media lashings and online pile-ons for failed startups and their founders that we are measured and empathetic. The sun will still come up tomorrow, and good people always deserve a second chance. Those who tried to build Supie deserve this from us, just as Jake Millar deserved it two years ago.

0 Comments

Please click for larger version Please click for larger version A small followup on the passing of my father, Sir Roger Bhatnagar, that I announced yesterday on LinkedIn and here. In the 1980s, Dad regularly used full page ads in the NZ Herald to great effect to promote his electronics retail business Sound Plus, with aggressive discounting, some "swashbuckling" types of marketing like Pyjama Parties (where people would queue up Queen St in their pyjamas to buy heavily discounted VCRs and TVs), and other innovations. It was very much in the spirit of the times when electronics became accessible to the home, NZers were keen to have fun, and they were hungry for the latest gadgets as NZ became a more open economy. So I thought it would be a nice tribute to sign Dad's life off publicly with a full page ad in the Herald - "Page 20" - which happens to be the medium he loved for his own business. We has also organised the official obituary notice as well for this morning's family notices. Special thanks go to Jordan Williams and his team at the NZTU/Campaign Company for helping me with this ad. (Also posted on LinkedIn - click here)

In early March 2022, we were contacted by a member of the public asking if the website "www alliance equities dot ltd", (remove all spaces and replace word dot with the symbol dot) was a part of the Bhatnagar family networks.

It is not, and that website represents a fraudulent use of our NZ Companies Office details and registered address. It is highly likely an attempt at fraud on those who give them their money or crypto wallet credentials. Our Alliance Equities Ltd has never been involved in any form of cryptocurrency. Those who are visiting the website in question need to understand that they are at risk of fraud and should not engage further with that website. Anyone who believes that they are at risk of financial loss should contact the Official Cybercrime agency for their country. CERT NZ Australian Cybersecurity Centre FBI Internet Crime Complaint Center Indian Cybercrime Reporting Centre See here for more information on the real Alliance Equities Limited of New Zealand website. I have also posted a warning on Linkedin. I recently attended the memorial service for Jake Millar, the founder of Unfiltered, who took his own life in November 2021.

I was not just an investor in Unfiltered, but someone who was also a friend of his. The day after his memorial service, I shared a number of thoughts about Jake and his untimely passing on LinkedIn. (click through) Rest In Peace Jake. I like Sharesies. If it encourages people to get involved in investing, it can only be a good thing. But lately, I've seen a few people on the Sharesies Facebook forum make comments like "Why have my shares gone down????? 😞😞😞", as if it was somehow wrong or inexplicable.

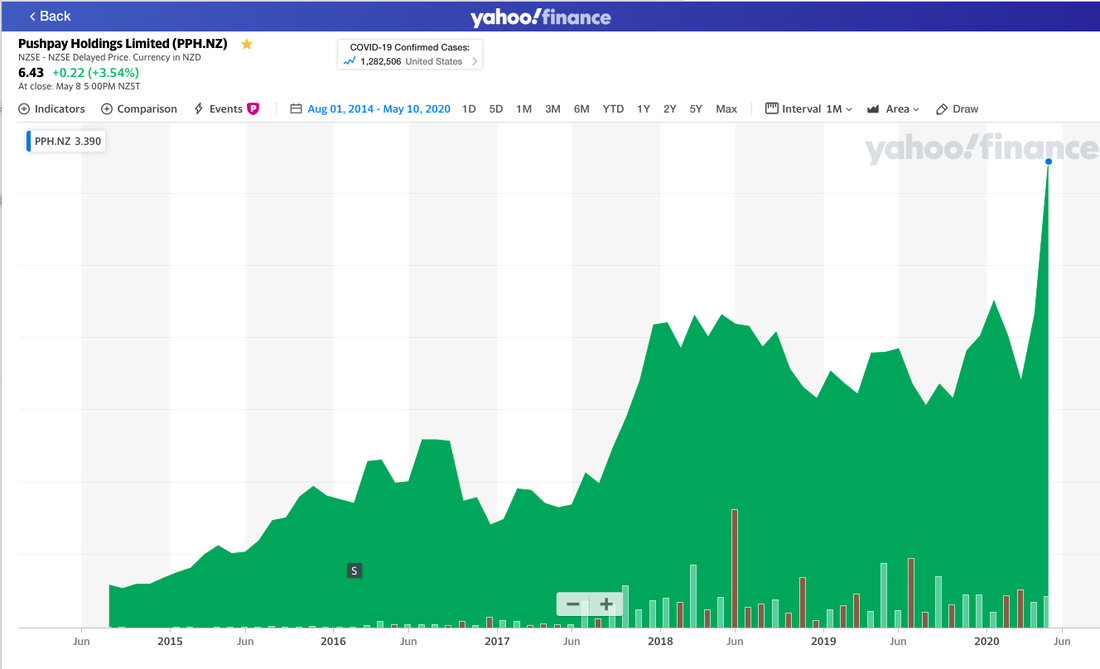

As a more seasoned investor, I thought I would help the forum with some thoughts. I've had the pleasure of being an active share investor for a number of years now, and I thought I'd add some food for thought for some Sharesies investors here, as I've noticed a few have been worried whenever there is a "down day", asking questions like "why are my shares going down?". Last Friday, I concluded the greatest journey of my life - my investment journey in Pushpay. Over the course of last week, I exited the last of my stake with the share price at record highs, on the back of a superb annual result.

Our family invested in Pushpay in March 2014, not long after Peter and Chris Huljich made their first investment in late 2013. I recall meeting Chris Heaslip and Elliot Crowther at their Glenfield offices in February 2014 - threadbare carpets, lack of space and tired surrounds, and found myself instantly liking them and their pitch. They had clarity about the problem they solved, and size and scope of the opportunity ahead of them. Our family made our first investment shortly after that meeting, and followed up with heavy participation in subsequent raises, becoming Pushpay’s biggest non-insider investor.  This is a post I’ve been looking forward to for a few months now. Auckland has been great to the Bhatnagar family since we arrived from Canada in 1980. We’ve prospered in business over two generations, been heavily involved in both political and social circles, and now we are the happy position of giving back to great causes with philanthropy. On December 11 1997, Mara and I had our first date at the Auckland Art Gallery.

We continued the tradition of art gallery visits, and on December 11 2004, Mara and I hosted our wedding reception in what is now the old wing of the Auckland Art Gallery. As an Auckland City Councillor between 2007-2010, I was a strong supporter of the Auckland Art Gallery’s modernising and enlarging. Which brings us to today: December 11, 2019. Today, Mara and I are celebrating our 15th wedding anniversary by announcing our joining the Auckland Art Gallery Foundation as “Governors”. We have committed to a substantial philanthropic contribution to the Gallery, and have also joined our three boys up as “members”, perhaps in the hope that the Art Gallery might make a nice place for them to hang out with girlfriends in future years. Our names have gone up on the wall in great company with other generous Aucklanders. While we love to give to Auckland related causes, the Auckland Art Gallery is an especially sentimental choice for us given its strong connection to the starting of our own family, and our own interests in collecting art. If you haven’t been to Te Toi O Tamaki lately, get there - you will love this jewel in Auckland’s crown. The current Colin McCahon exhibition "A Place to Paint" (curated by Ron Brownson) runs to the 20th of January next year, and is unmissable for Aucklanders. Recently, I've been asked a number of times about what books I'm reading or podcasts I'm listening to. I have typed them up and published them online here, but thought it might be useful to also reference them as a blog post as well.

My favourite books are mostly about business, and most viewed through the prism of "value investing", or buying assets cheaper than their intrinsic worth. Value investing was "invented" by Dr Benjamin Graham, a noted investor but also famous for being the Professor of the University of Columbia's School of Business that taught Warren Buffett. Others on the list are about behaviour - optimising the size of the investment for risk, contrarian investing (also put as "zigging while others zag"), as well as more recent metrics focused books. Here they are: Books (all links go the book's page on Amazon.com)

Podcasts (all links to Apple Podcasts) Interview with Unfiltered TV: Continuing a family legacy - investing in high growth businesses18/1/2019  Click here to watch the interview at Unfiltered, posted 18 January 2019 The following interview was done in September of 2018 and posted publicly on January 2019. It may be of help to entrepreneurs seeking to understand the mindset of early stage high growth investors. Key takeouts from the interview: |

CommentaryThis mini blog contains infrequent public commentary by Aaron Bhatnagar mostly on business, but also political and philanthropic matters of importance to him.

Archives

October 2023

Categories |

RSS Feed

RSS Feed